DEAR FELLOW SHAREHOLDERS,

When I think about all Tejon Ranch has accomplished since it was established in 1843 as a Mexican land grant, and when I consider its tremendous beauty, utility, and value in more recent times, I’m reminded of the craftsmanship of a master jeweler, who takes ordinary raw materials and—in time—turns them into precious gems. Much like a jeweler, Tejon Ranch has cut and polished this land into something of even greater value. It has built a California Crossroads: from stagecoach stop to economic powerhouse.

Originally used by Native American tribes, and later by trappers, traders and explorers, the vast majority of the Ranch remains a beautiful wilderness and working ranch, while small strategic portions of the land have been dedicated to responsibly creating both a growing and vibrant industrial and commercial community and -- longer term -- several master planned residential real estate developments to benefit today’s Californians.

TEJON RANCH COMMERCE CENTER (TRCC)

A Rare Jewel, Increasing in Value

Since breaking ground, we have developed a bustling, state-of-the-art industrial/commercial complex along the heavily trafficked Interstate 5, California’s primary north/south corridor. Once uninhabited land, TRCC has been “cut” into a rare jewel, home to a who’s who of international and U.S.-based companies and visited by more than 20 million people per year.

With current entitlements for over 20 million square feet of commercial and industrial assets, as well as plans to build a multi-family apartment complex immediately adjacent to the Outlets at Tejon, TRCC is an important part of our present--as well as our future. Strategically located, TRCC includes a highly successful industrial park, which is home to distribution centers for some of the world’s largest companies such as Ikea, Dollar General, Caterpillar, Famous Footwear, L’Oreal, Camping World, and others. Absorption of these assets has occurred through our own development efforts, those in conjunction with like-minded joint venture partners, or through land sales. TRCC also boasts one of the busiest travel centers in the country, a triple-net leased commercial and retail portfolio with high quality tenants such as Starbucks, Chipotle and McDonalds, and an open-air outlet center. We have already absorbed 8.9 million square feet, with an additional 11.1 million square feet of industrial/commercial space available for future monetization.

In addition to the entitlements we’ve earned, and our own development expertise, current market drivers are adding to our success, and we are aggressively marketing the benefits of TRCC. Among other features, there are significant labor and logistical advantages to the site, including the pro-business approach of Kern County (where TRCC is located), as well as the demonstrated success of current tenants and owners within the development.

TRCC’s location fits within the logistics model that many companies are employing, which favors large, centralized distribution facilities that are strategically situated to maximize the balance of inbound and outbound efficiencies, rather than many decentralized smaller distribution centers. With access to markets housing more than 40 million people for next-day delivery service, TRCC’s tenants also are demonstrating success with e-commerce fulfillment. Additionally, TRCC’s Foreign Trade Zone (FTZ) designation allows businesses to secure the many benefits and cost reductions associated with streamlined movement of goods in and out of the trade zone. The FTZ designation is supplemented by the Advance Kern Incentive Program, which aims to expand and enhance Kern County’s competitiveness by taking affirmative steps to attract new businesses and to encourage the growth and resilience of existing businesses. As demand for industrial development continues to expand, we are experiencing, and continue to anticipate, higher pricing, accretion, and additional cash flow.

Building on significant activity at TRCC in 2021, the immediate past year was another very active one for us, with more than 2.5 million square feet of transactions under construction or scheduled to begin construction in 2023.

Among these projects:

- In February 2022, Dedeaux Properties, a Los Angeles-based industrial developer, acquired 12 acres for a 240,000 square foot spec industrial facility. Construction began in September 2022, and completion is expected in the Spring of 2023.

- In July 2022, an end user who has requested confidentiality, acquired 58 acres for a planned 725,000 square foot distribution facility. Construction is planned to start this year, with occupancy anticipated in 2024.

- In October 2022, we completed the construction of a 629,000 square foot industrial building owned by a Tejon Ranch-Majestic Realty joint venture, which was immediately leased to IKEA, giving the major international retailer a presence on both sides of TRCC.

- Finally, in December, Sunrise Brands, a leading designer, producer, distributor, and retailer of both branded and private-label apparel, including for Donald Pliner, Rebecca Minkoff and NYDJ, among others, leased a 446,000 square foot building prior to the start of construction. This new distribution center is part of a new TRC-Majestic Realty joint venture, and construction began in early 2023. Until the new building is complete, Sunrise will take up temporary occupancy in half of the 480,000 square foot building co-occupied by Salon Centric (L’Oreal).

While higher interest rates increase the cost of capital and could slow growth in the industrial sector, we have not yet seen any evidence to that effect. Industrial occupancy rates are expected to remain high, and industrial users seeking larger spaces are going further north from Los Angeles into neighboring Kern County, and particularly, to TRCC, which has attracted increased attention by end-users and major industrial investors alike, as market conditions continue to tighten. In a recent article in the Los Angeles Business Journal, Rishi Thakkar, who handles acquisitions for the aforementioned Dedeaux Properties, had this to say about TRCC.

“The Greater Los Angeles market is increasingly becoming supply constrained putting upward pressure on rents, which in turn places greater pressure on supply chain costs. Tejon Ranch, which is strategically located in the southern portion of California’s Central Valley, is a location that’s proven to represent a superior value proposition for regional users who need to move goods throughout the western United States.”

Recent market data supports growing demand for traveler-related business at TRCC. Our first Travel Center, owned 60% by Tejon Ranch through a joint venture with Travel Centers of America, opened in 1999 with a second travel center opening in late 2009, and has grown into an irreplaceable asset that capitalizes on its strategic positioning along the I-5. The Travel Center now serves more than 80,000 commercial and passenger vehicles passing through each day. Over the last three years, our TA/Petro partnership has paid out $29 million in dividends and has seen revenues increase 33% between 2021 and 2022, testament to demand and our ability to maintain or increase margins. We plan to devote more aggressive marketing around the substantial benefits of what we are branding as, the “Oasis on I-5.” Over the last five years, industrial land values at TRCC have increased 151%, and industrial rents have increased 188%.

In 2022, we launched an exciting, strategic project at TRCC...the first residential development on Tejon Ranch. The plan is to build up to 495 apartment units and associated amenities on a 27-acre site directly adjacent to the Outlets at Tejon. The development project, which is currently in its planning and design phases, will complement the Outlets and is expected to generate additional activity throughout the entire Tejon Ranch Commerce Center.

The Outlets at Tejon also take advantage of its prime location on the north/south California corridor. Although traffic declined slightly in 2022 as government-provided stimulus waned, and sales for occupied stores mirrored traffic trends, other key operating metrics, such as core store sales, are holding steady. In addition, the center’s occupancy increased from 76% early in 2022 to 79% at year-end, with the addition of several new stores, including an Ariat temporary store and a Vans. When Ariat’s permanent stores (there will be two) open for business, along with new stores for Nautica and Forever 21, the center will be nearly 85% occupied.

TRCC, a story of growth and success, serves as the backbone for future development and growth, while generating current positive cash flow and value appreciation. When combined with revenue generated from our substantial water resources, other mineral operations, significant ground leases and agricultural operations, which are incredibly significant in their own right, we have the means and know-how to further advance plans for several master planned mixed-use residential communities to derive additional cash generation and value, creating new and additional gems from the Ranch’s land holdings.

five years...

HIGHLY DIVERSIFIED OPERATIONS

Developing Raw Land into Priceless Resources

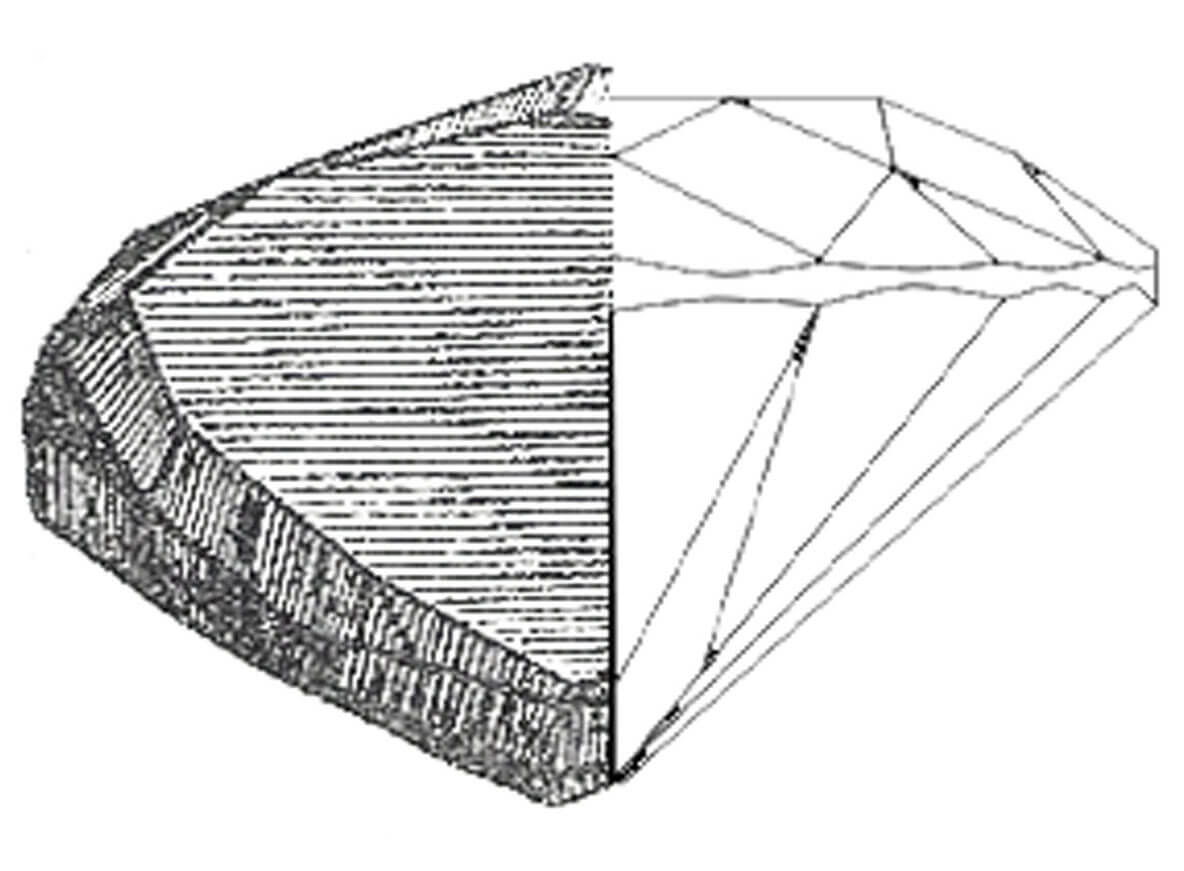

While our Commercial/Industrial operations segment represents our largest cash flow generator, several other Tejon Ranch operating segments also generate substantial cash flow, while providing much needed resources for California, now and in the future. In total, mineral resources royalties, exclusive of water sales, generate an average over the last three years of nearly $5.7 million in revenues annually. These businesses do not require significant capital resources, making them highly strategic and accretive.

Water: Drought conditions in California, especially in 2022, make our unique water assets extremely compelling. Tejon Ranch uses its own water assets and also sells water to others. As anticipated changes arise in the future related to groundwater management in California, such as limits on groundwater pumping, we believe that our water assets, including water-banking operations, ground water recharge programs, and access to water contracts, like those the Company has purchased in the past, will become even more important and valuable in servicing our own projects and providing opportunities for water sales to third parties. Owning water assets not only provides current value, but is instrumental in creating future value through water sales to the water districts that will ultimately provide service to the Company’s master planned communities. Over the last three years, Tejon’s water assets have generated an average of $12.0 million in revenues annually.

Farming: Our farming operations form a solid foundational business for Tejon Ranch, although 2022 was challenging, principally because of weather issues, the timing of crop production, and supply chain disruptions, among others. For example, it was a down-bearing year for pistachios, and we had no production. Almond inventory across the country was stockpiled, depressing prices. We do expect our crop insurance to offset some of these losses. In 2023, we anticipate making investments in this business as part of a long-term farm management program for redeveloping declining orchards and vineyards to maintain and improve future farm revenues. Although the last few years have been a bit challenging for our agriculture business, over the last 10- 20 years, it has generated positive cash flow.

MASTER PLANNED COMMUNITIES

Shining Gems in the Making

We also are leveraging our land ownership and the experience we’ve gained through the entitlement of TRCC to develop future residential communities. These communities are expected to help lessen California’s severe housing crisis, while generating substantial additional revenue and cash flow for Tejon Ranch. We plan to utilize the cash flow generated from operational assets to assist with the capital requirements for these communities, while also seeking like-minded joint venture partners as we have done successfully at TRCC.

The current housing shortage California is staggering. We already have a deficit of more than three million units and the production new housing still lags population growth. Kern County grew more than 9% according to the latest census, while the population in Los Angeles County remained steady at nearly 10 million. There is a large and untapped market for new homes in areas all around Tejon Ranch.

Our Mountain Village and Grapevine communities have received their initial legislative approvals. Centennial did receive its initial legislative approval, but a recent Court decision will require additional processing within LA County to correct Court identified issues in the environmental documentation and an additional approval.

After the multi-family residential project, we anticipate that Mountain Village will be the next to break ground, although we have not yet announced a timeline. We are continuing to work through detailed engineering for this 3,450-unit mixed-use community, which will require capital, likely through a like-minded joint venture partner. Mountain Village is situated in one of the most beautiful sections of the Ranch. A conservation-based community, homes will feel organic to the landscape, surrounded by spacious open areas.

Our Grapevine mixed-use community, entitled for 12,000-units, located at the base of the foothills in the San Joaquin Valley portion of the Ranch, and supporting and expanding the economic development activity taking place at TRCC - will be inspired by the region’s rich agricultural heritage. We’re planning for Grapevine to be a complete community, with homes, commercial and civic uses, educational and medical services. Grapevine received a favorable ruling in the Kern County courts in 2021 regarding re-approval of development plans, and we are currently seeking/finalizing state and federal permits.

Our Centennial mixed-use community is committed to achieving a net zero carbon status that exceeds California’s climate goals. Centennial, planned for approximately 19,000 residential units and 10.1 million square feet of commercial/industrial space, is located in the northwestern portion of the Antelope Valley and is envisioned as a unique, self-sustaining, and affordable community.

FUTURE GROWTH

Managing toward a Bright Future

Tejon Ranch has created substantial value from its current cash flow-producing assets, enabling us to enhance the monetization and value of these assets, while creating meaningful opportunities for growth. We also are focused on further leveraging our highly strategic location between two strong, undersupplied housing markets of Los Angeles and Bakersfield by pursuing the entitlement and development of mixed-use master planned communities.

We continue to expect that substantial investments will be required in order to develop our land assets. In order to meet these capital requirements, we may need to secure additional debt financing and continue to renew our existing credit facilities. As we move into 2023, we have a strong balance sheet and will be evaluating various options for funding the potential start of development projects. We believe we have adequate capital resources to fund our cash needs and our capital investment requirements in the near-term, especially as it relates to expanding our footprint at TRCC.

We believe we have the right team in place to successfully execute on our plans, including the ten highly qualified, diverse, and experienced professionals comprising our board of directors.

Looping back to my comparison of development at Tejon Ranch with the work of a master jeweler, we’ve worked tirelessly to turn 270,000 acres of contiguous land in the prime Southern California market, into a place where not only are flora and fauna protected for the enjoyment of all, but into a place where commerce thrives and where Californians will be able to hang their hats, raise their families and delight in the many benefits of our master planned communities.

Thank you to all our stakeholders for your loyalty, and for following our journey as we create something truly valuable through the strategic development of a one-of-a-kind, outstanding cash flow producing asset.

Sincerely,

Gregory S. Bielli

President and CEO

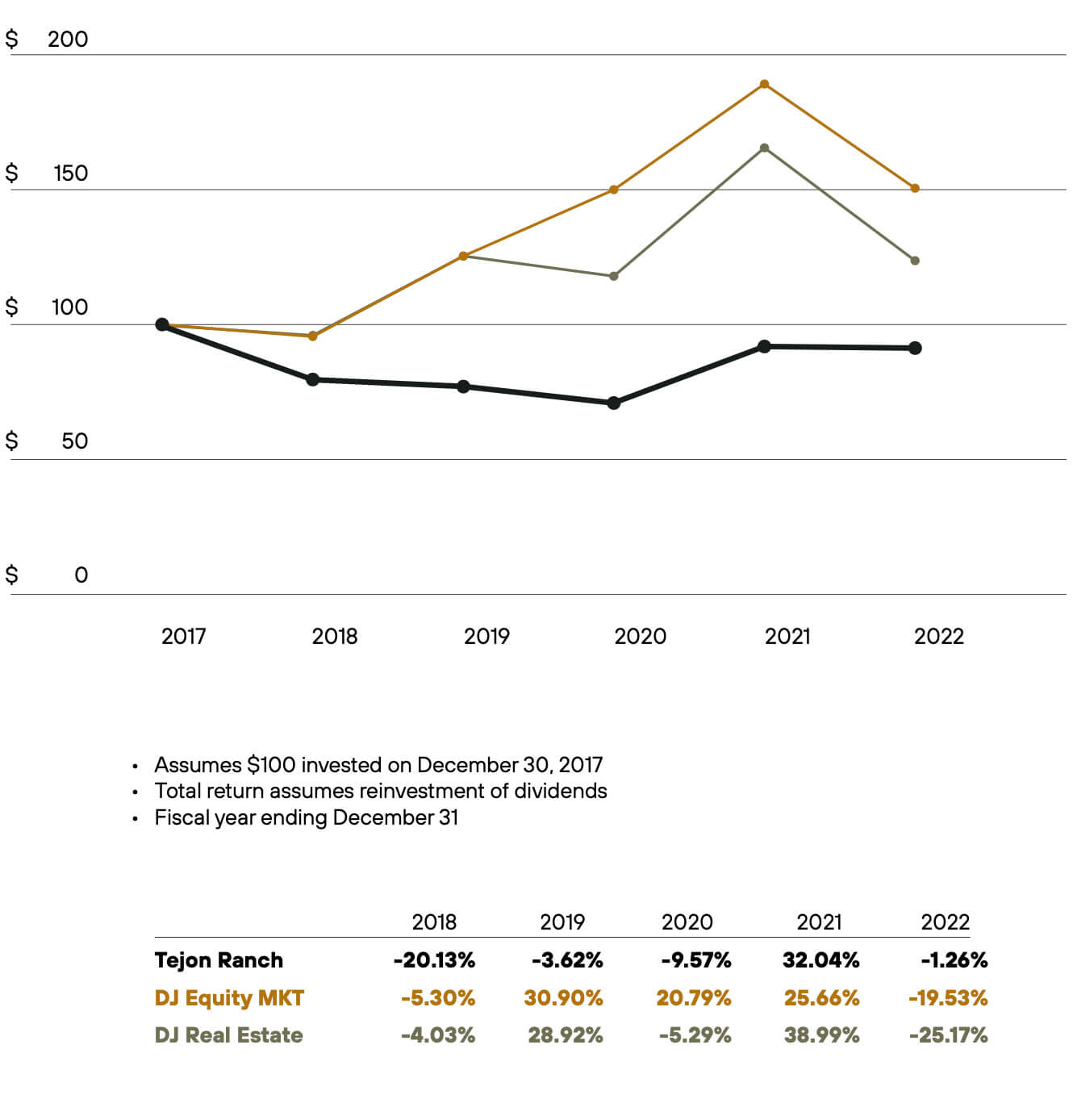

COMPARISON OF

FIVE YEAR CUMULATIVE

TOTAL RETURNS

The stock price performance depicted in the above graph is not necessarily indicative of future price performance.

The Performance Graph will not be deemed to be incorporated by reference in any filing by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, except where the Company specifically incorporates the Performance Graph by reference.

The Dow Jones Real Estate Index, for the most part, includes companies which have revenues substantially greater than those of the Company. The Company is unaware of any industry or line-of-business index that is more nearly comparable.

CORPORATE DIRECTORY

BOARD OF DIRECTORS

Norman Metcalfe

Chairman of the Board, Tejon Ranch Co.

Real Estate and Investments

Steven A. Betts

Managing Director of Development Holualoa Companies

Real Estate Development

Gregory S. Bielli

President and

Chief Executive Officer, Tejon Ranch Co.

Jean Fuller

Retired California State Legislator

Susan K. Hori

Partner and Land Use Attorney Manatt, Phelps & Phillips, LLC

Anthony L. Leggio

President,

Bolthouse Properties LLC Real Estate Development and Management

Rhea Frawn Morgan

Managing Member and Chief Executive

LDC Advisors, LLC

Real Estate Development

Geoffrey L. Stack

Managing Director, SARES-REGIS Group Real Estate Development and Management

Daniel R. Tisch

Managing Member, TowerView LLC Investment Management

Michael H. Winer

Private Investments

EXECUTIVE OFFICERS

Gregory S. Bielli

President and

Chief Executive Officer

Allen E. Lyda

Executive Vice President, Chief Operating Officer/ Chief Financial Officer Assistant Secretary

Hugh F. McMahon IV

Executive Vice President, Real Estate

Marc W. Hardy

Senior Vice President General Counsel Corporate Secretary

Robert D. Velasquez

Senior Vice President, Chief Accounting Officer

CORPORATE INFORMATION

Corporate Office

Tejon Ranch Company

Post Office Box 1000

4436 Lebec Road

Tejon Ranch, California 93243

Telephone: (661) 248-3000

Securities Listing

Tejon Ranch Company Common Stock is listed on the New York Stock Exchange under the ticker symbol: TRC

Stock Transfer Agent & Registrar

Computershare Shareholder Services LLC

480 Washington Boulevard Jersey City, NJ 07310-1900

Telephone: (877) 898-2101

Auditors

Deloitte & Touche, LLP

Form 10-K

A copy of this report and the Company’s Annual Report to the Securities and Exchange Commission on Form 10-K, without exhibits, will

be provided without charge to any stockholder submitting a written

or electronic request to Investor Relations:

Barry Zoeller

Senior Vice President,

Corporate Communications & Investor Relations

bzoeller@tejonranch.com

Tejon Ranch Company

Post Office Box 1000

Tejon Ranch, California 93243